One of our content writers has been self-employed for eight years and counting. In this article, he’ll guide you through 4 common mistakes to avoid while working as a freelancer.

Being self-employed opens up possibilities you don’t typically get with regular employment. As a freelancer, you have total control over the direction of your own career; you can often choose your own hours; and you’ll have the opportunity to work from home or from a vibrant co-working space. No wonder the UK’s self employed population hit the 5 million mark for the first time in 2019.

But along with the benefits of self-employment, there are some risks that need to be dealt with. Avoid making these 4 common mistakes of the self-employed, and you’ll stand yourself in good stead to succeed as a freelancer.

Failure to register with HMRC and do your taxes correctly

One of the first things every freelancer should do is register as self-employed. If you’re already trading and you haven’t registered yet, do it the next time you have a chance – it’s quick, doesn’t cost anything, and the sooner you register the better.

Doing your accounts as a freelancer should be straightforward, assuming you are trading on a relatively small scale. A simple ledger, with details of all your revenue and deductible expenses (e.g. for work-related travel and office supplies) will usually do the trick. To get paid, you’ll need to supply your clients with an invoice with the details and price of the work (unless the client uses a self-billing system).

Self-employed people in the UK need to let HMRC know how much they’ve earned in each tax year by submitting a self assessment. After submission, the service will provide a calculation showing how much the person owes in taxes.

Handling finances and tax is certainly not the most enjoyable part of freelancing. However, if you stay on top of recording your income and expenses, and if you meet HMRC’s deadlines for registration and payment, you will find it’s really not as bad as some freelancers make out.

Over-reliance on certain clients

As a freelancer, you may sometimes lose a client without any prior warning. This can happen for reasons beyond your control – for instance, if the client goes out of business or reduces its budget for the service you provide. Since self-employed people rarely have any form of redundancy to rely on, this can be very disruptive to their finances.

Losing clients is part of life as a freelancer, so we need to set up our businesses accordingly. The best way to do this is to work for multiple clients – enough to enable you to still earn enough money to live off, even if one or two of them stop working with you. This is clearly preferable to being in a situation where losing one client would cause financial problems.

If you find yourself with an impossible-to-refuse offer of doing lots of work for just one client, there are things you can do to make this option more financially secure. For instance, you can ensure the contract for the work stipulates that the client must pay you for the full duration of the contract. Some clients will also be happy to pay a deposit at the start of the contract.

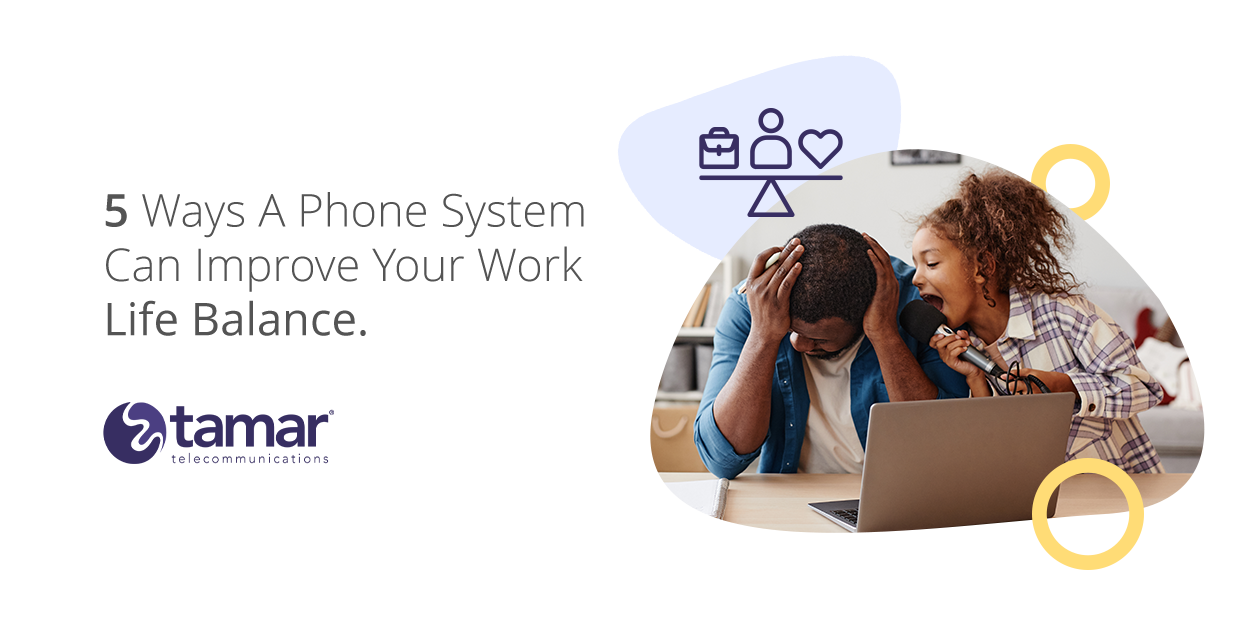

Getting the work-life balance wrong

You’ll sometimes hear freelancers say they feel like they’re always working. This doesn’t necessarily mean they’re constantly doing the main tasks of their job; more often, they are thinking about work, responding to emails and doing other work-related tasks on any day and at any time.

In some cases, working outside of normal hours might be what’s needed to get ahead as a freelancer. But as a rule, it is more beneficial to your health, productivity and relationships to stick to something close to office hours. The following steps will help you maintain a healthy separation between work and life:

● Decide on a place where you will do most of your work, such as a desk at home or a co-working space.

● Decide what your usual “office hours” will be. (Your office hours could be quite different to 9-5, if you prefer.)

● If you need to work outside of your main office hours, try to do this during a time period that you set aside for this purpose.

● Take proper holidays, with no work allowed.

● Ensure work time is productive by avoiding social media.

Freelancers should also aim to take regular breaks throughout the working day. This can actually increase productivity, and it’s also great for your health and happiness.

Unprofessional presentation

In self-employment, every time you communicate with a new prospective client is a bit like a miniature job interview. Whether consciously or subconsciously, the client will be making judgements on your professionalism, based on how you present yourself. As such, professional presentation is crucial to a freelancer’s work prospects.

Presentation best practices vary from industry to industry, but the following components are usually important:

● Professional email address

● Well-formatted, informative email signature

● Social media channel(s) for marketing

● Professional website or online portfolio

● Dedicated business telephone number

Covering these points properly is a huge step towards creating a professional impression.

The other side to creating a professional impression on clients and other contacts is to avoid making mistakes in how you present yourself and communicate. For example:

● Don’t post anything on personal social media that you wouldn’t want a client to see, as they might look you up.

● Avoid controversial statements and humour in professional communications.

● Don’t send important emails without proofreading and spell-checking them.

In this article, we’ve covered four of the most crucial mistakes freelancers should try to avoid:

- Don’t neglect your finances and self-employed status with HMRC;

- Don’t rely too much on certain clients for income;

- Don’t lose sight of the importance of work-life balance; and

- Don’t present yourself unprofessionally.

If you can cover all these points, you will put yourself in a great position to thrive as a freelancer. Good luck!